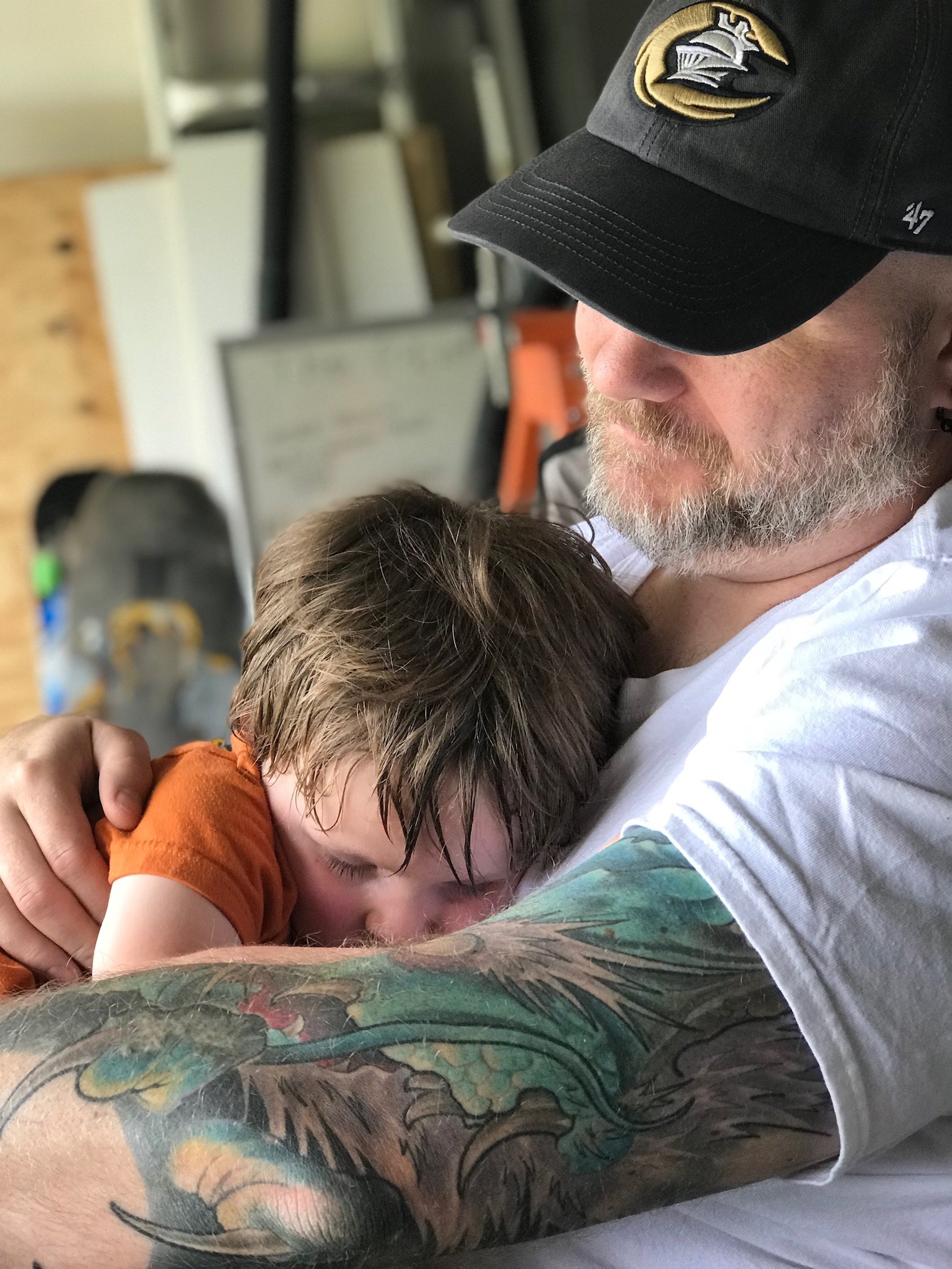

Hi all. Apologies if this is not allowed here. I know people out there are struggling, but I just want to share my good news with someone.

It’s a big milestone of accomplishment in my life, but I feel weird just telling family members or my online friends about it. The only other people who know are my coworkers because we all got the same raise. Money doesn’t go as far nowadays due to crazy inflation post COVID and my area has higher cost of living than where I grew up, but I’m still very happy about this. I remember back when I used to only make minimum wage. All those years of schooling eventually made their way back to me. I’ll never make as much money as someone like a doctor, but it’s definitely enough for me to live comfortably as a single person.

Anyway, I’ll delete this in a bit (or sooner if it gets removed by a mod), but I hope you guys out there have a good weekend.

Edit: Thank you guys very much :)

Edit 2: Jeez there are so many more comments than I expected. You guys are so nice!!

Congrats! The trick is to not increase your spending, and take the excess and either save it or invest it. Remember: just because you can afford it, does not mean you need it. :)

The trick is to increase everything proportionally. Not increasing your living standards is just poor people logic.

Absolutely make your life better in the moment. There’s no telling whether you’ll keel over in two days from an aneurysm and all that saving did absolutely nothing.

But yes, 401k > Mortgage as long as you’ll be saving for 30 years or more. You’ll need about a million or more to retire comfortably these days.

Ok, I’ll give that if a person is living in less than ideal standards, getting a raise is a great way to enhance their quality of life and could be argued is necessary.

I didn’t outright say this, and I should have, but I was referring to spending for the sake of spending; I.e., I got a raise so I’m going to go out and buy a PS5, new super computer, a BMW, etc. there’s nothing inherently wrong with buying those things. It’s simply a matter of doing so responsibly.

As for poor people logic, so what? It’s sound logic. Of course it works for me personally. YMMV. But I have gone through a chapter 7 bankruptcy in my 20s, and now my FICO is around 800. For me, it was the mentality that I had money so I should spend it that got me in financial trouble. Treating my money as an asset that should be cared for got me out of trouble.

This only matters if you’re making more than your peers. Most of my friends had engineering degrees coming out of college so we weren’t massively different in compensation. I’m pretty open amongst them, but I wouldn’t tell anyone how much I make it i thought it was more than 10-20% different than them.

This only matters if you’re making more than your peers.

Ehhhhhh. Eating better costs money. Home improvements or not living in a shit hole costs money. Clothes that aren’t 10 years old costs money. Children. Health. Teeth. Eyes. Safe vehicles. Green living.

It all costs money and is prohibitively gated by cash.

Improve your life now. Quit buying shitty cheap products and buy better ones. Vimes Boots. Take a vacation to somewhere that isn’t your couch.

There’s so much that isn’t some Lemming’s idea of trying to reconcile being poor so they aren’t out murdering billionaires.

In all seriousness though, congratulations on your life changing accomplishment. Keep up the great work!

Congrats and well done! Take some time to celebrate! (And then max out your 401k if you’re in the US and you haven’t already)

Yeah I’m bad at figuring out how stuff like that works tbh lol. I think the last time I looked at my 401k stuff it said that I should be contributing more than I am for some reason. Gotta figure out how to adjust that.

I’m going to have some new financial goals now, but I’m not sure what they’ll be. If it should be something like working towards paying down loans first, which loans to pay down first (I have a very large amount of student loans after all this and I also have a mortgage), or if I should work toward improving my living space and making it nicer. We’ll see I suppose!

Might be worth working with a financial advisor, we just got one and I feel much more comfortable with my money stuff

Wwell I know at the very least, a financial advisor probably would tell me not to invest it in my home like that. That part would be me weighing doing something for myself that isn’t totally necessary vs. the more responsible financial decision. But a financial advisor might not be a bad idea in general!

Any discouragement about upgrading your home should be taken in the context of you living in your home. If you are going to move in the next couple of years not spending 20k to upgrade your kitchen when you can apply that 20k to your next house is a good choice since it probably won’t increase you sale price. But if you plan on staying a decade, get the upgrade and enjoy yourself.

Yeah, living space upgrades are not a good financial investment.

I would suggest you pick a few smaller or low cost upgrades to get the most bang for the buck, for example, fix up your entryway, fix up your curb appeal a little. Make your space a little more pleasing to walk into.

Get some savings going for emergencies, and start paying down your loans from highest interest or lowest interest. You may be able to look at consolidating the loan with a private bank to get a better interest rate.

I guess my point is that just because it’s not technically a good financial investment doesn’t mean that it’s necessarily always a bad idea. You have to do things for yourself now and then too. We only have one life on this planet and living like you’re homeless just so that you can pay some giant corporation off slightly quicker isn’t necessarily the right move for mental health and general life happiness, even though on paper it’s the best move financially.

In general, I would consider myself to be fairly cheap compared to some others I know. I don’t have a ton of expenditures and I don’t carry any “bad” debt like credit card debt or anything. My loans are only my mortgage and federal student loans.

Yeah, too many people look at the numbers and try to give advice solely on those. However, while it would be nice to maximize your returns, the entire point of working for money is to benefit your life. I understand that part of this tendency is that common bad spending g habits benefit the current self at the expense of future self, but we all should be looking for that balance where both can be happy

Yup, exactly! It’s figuring out that balance that’s the important part. I’ve known people on both ends of the spectrum…some who spend excessively to the point where they go into massive debt, and some others who take the opposite approach and never do a single thing nice for themselves. Interestingly, two people I was closest to in my life exhibited these polar opposite behaviors, so I’m able to witness these effects firsthand.

It’s a process trying to find the right balance. I’m at a bit of a life crossroads and trying to figure out some of that myself. I think for me, personally, I actually need to start spending a bit more on life experiences as opposed to saving every penny.

As well, if there are large credit card balances, consider a zero interest for n months, and see if you can pay that off within that time.

I’m sure there’s a personal finance thing around here somewhere!

Personally, I’d work on making sure I have a cash safety net. Something like 6 months expenses in my favorite high yield savings account.

After that I would pay off any loans with a high rate. If the rate is <5 percent, it may be worth putting that money into a 401k or investment account. If it’s above 5 percent, I’d consider paying it off early. The idea being that if it’s a low rate then you can invest that money and earn a higher return than it would cost you.

Aside from that, I’d do my best to max my 401k contribution to take advantage of those sweet tax benefits. If nothing else, make sure you’re taking advantage of any employer matches.

Again, awesome work on the job!

Doing your best for both your present and future self is usually a balance.

Some functions that were helpful to me were

- half your raise into savings or retirement. You’re less likely to overspend if it never gets into your checking account. At the same time, you still get a nice raise

- some 401k plans offer an automatic increase. It would be a hardship to my current self to suddenly max out my 401k, but if my co tribution automatically bumps up 1-2% every year, present self wont really notice the loss and future self will thank me for growing toward maxing my 401k

Remember the most important part of your retirement savings is just doing it. The power of compounding returns over many years can be more important than which investment might do best. Remember that your contribution is something you control whereas most investment choices are speculative and you have no say over whether they do well or not

Hi, congratulations! I’m so happy for you. Please consider a reputable financial advisor. Not some slick, well-advertised person, but someone who comes with a decent reputation. When meeting with them, use some intuition, don’t fall for flattery or wild promises. You can always say you want to consider their advice. Some lawyers also offer this type of service. I woods encourage you to be kind to others and our environment, with your investments.

Congrats again, well done!

Check out The Money Guys on youtube, they give good financial advice

Thanks for the recommendation!

Instead of investment advice, I’ll just say never forget how hard you had it, what it was like to get minimum wage, and remember there are always hard workers being paid less then you that also deserve a shot. You did the work, be proud of what you’ve achieved. But probably don’t get into specifics with family, people get weird about money.

I’m gonna double down on your advice and say don’t tell anyone how much you make, except your SO. If someone asks just say “I’m doing well for myself.” And if they press you say “I prefer to keep the specifics private”. When I started bringing in money I made the mistake of calling my friends to celebrate and within months they were all hitting me up for cash and pulling on my heartstrings.

Damn that’s a real thing?

Yeah, sadly. I get messages like “Hey Kit, I’m $50 short on my heating bill this month. Can you help me out?” All the time. A lot of passive aggressive stuff too like people complaining about money but not straight up asking for it until I give 50 "Damn that sucks"s.

My uncle has money. Every problem from his siblings to his 5th cousins gets him a phone call haha.

I don’t have any advice. I just wanted to contribute a humble HELL YEAH BROTHER.

I’m what you might call a well wisher in that I don’t wish you any specific harm

That is so amazing. Congrats!! It must feel incredible to make that kind of money now. A six-figure income seems almost to be the minimum a person should earn if they want to survive and live well in the world these days.

I never earned a huge salary (I think my highest was $27,000 in one year) as a healthcare worker, but I came into a family trust later in life when my parents kicked off. So now I have a lot of money in the bank - and like you, not anyone close to share it with.

The only good thing is I retired early and now pretty much have all my time to myself - nobody to share it with, but that’s OK because I feel like I keep busy and I’m into things like painting and playing music and hiking - so I never feel like I have time to just sit and brood about things.

I just want to say congrats and you deserve to feel happy about your situation. I wish you all the best!!

Nice, but save your money. The best time to do that is now.

Hey nice! My father has always told me that his biggest regret was not maxing out what he was allowed to put into retirement. You don’t care when you’re young, but it makes a HUGE difference for the second half of your life!

To add on, if your company matches for 401k contributions, NEVER put in less than the matching amount. Like, if they’ll match contributions up to 5%, never go below 5%. There are very few times you get legitimately free money in life, and this is one of them. Always put in more if you can, ofc, but the minimum should be the matching amount.

Congratulations you made it

You leave this post up then when you’re feeling down look at the messages.

Fuck yeah man, gg. I’ll never forget the day I hit 6 figures and how proud I felt. Soak it in - you earned it!

As one of those people who is struggling a bit: Never let the state of the rest of the world stop you from celebrating your own wins!

Congrats on the raise, that is really awesome. Remember to put a decent chunk into savings :D

Cheers bro, to each one of these six figures 🥃🥃🥃🥃🥃🥃

Congratulations! As someone who moved countries and started at the bottom ($6 per hour and 15 hours days) I know the feeling of looking back with disbelief. Sounds like you really earned it!

Congrats! Some unsolicited money advice I wish I had known earlier in my career:

If you have a mortgage and the interest rate is less than 7ish percent and you’re wanting to pay it early, something to consider:

You might put whatever extra you were planning into a Roth IRA until it’s maxed and also max out your 401k if your employment has that. Historical yield is 7ish% and compound interest will help you immensely 20-30 years down the line.

Paying off the house early is nice feeling but you can possibly refinance for lower rates later if it’s currently similar to or higher than historical investment yields. You could also do a little bit of both but prioritizing retirement accounts is the smarter move imo. So if your mortgage rate is 5% and you want to pay that down, you’re leaving 2% on the table by not putting it into either an IRA or an index fund instead.

This is assuming you’re not carrying other debts at higher rates like credit cards, those should be your priority. Next would be 3 months of all bills saved up, you can find some decent interest rates on savings accounts. I have Acorns and it’s at 5% so the 3 months reserves will stack interest for you too.

I forget what my mortgage rate is but I think it’s somewhere between 5.8-6.8%. I’ll have to look it up.

My wanting to eventually pay the mortgage off earlier is to dramatically decrease my monthly bills and make it easier to save and easier to put money in my pocket each month. I’m not really keen on dumping all of my money into something like an IRA. I discovered recently that high yield savings accounts are a thing and I’m much more comfortable with that. Granted, mine is only like 4.3%.

While I do need to put more into retirement and do plan to contribute more to my 401k, I don’t really want to go ham over putting every penny I have into retirement. Life is uncertain and you really don’t know how long you’ll live, even if you try your best to do a healthy life. It’s all about balance between enjoying the now and planning for the future, and not putting too much emphasis on one or the other. You don’t want to live like you’re homeless only to die in a car accident and never get to enjoy what you’ve worked for.

Absolutely! I grapple with that all the time. I love having fun and traveling and having cool stuff. It’s fun having some money you’re not afraid to spend.

You deserve it, you’re the one who got yourself to where you’re at. At the end of the day do what’s right for you, just maybe spend a little bit less over the years and instead put it toward the end game.

As time goes on, sitting on ass collecting interest and being able to live off that interest comfortably will be awesome, and if you were able to live it up the whole time is priceless. Treat your now self and future self, but future self likely won’t regret now self traveling etc. (so long as you’re not doing illegal tax evasion and damaging your body long term lol)

This is great advice. Hearing about people paying off their super low rate mortgages early is kind of shocking. With rates higher now that’s literally just throwing money away.

Oh yeah and if you math it out over 30 years, 2% can be a difference in the hundreds of thousands

You can max out a 401k?

Yeah it’s like 21.5k for 2024. They have yearly maximums on retirement accounts in the US, and that number is higher if you’re past a certain age (“catch up”). IRAs are a lot less, like 7k this year

I think it’s 23k for 2024.